How To Manage Your Currency Exposure When Buying An Overseas Property

Currency market volatility can play havoc with your overseas property plans. When sending a large amount of money, a slight change in the exchange rate can make a huge difference.

The British pound and many other currencies have recently experienced unprecedented volatility. Thankfully, you can take steps to ensure you are not left at the mercy of currency market volatility, allowing you to plan and establish an accurate budget for your overseas property.

For many buying a property overseas, it can be the first-time sending money overseas. Understanding the whole process and currency market movements can be daunting. Thankfully, it is not as complicated as you might think. A currency specialist can provide expert help and guidance, along with some currency tools that will help you protect your property costs from currency risk.

For large transactions, a Forward Contract allows you to lock-in a favourable exchange rate up to 2 years into the future. So, when your forward contract becomes due and it’s time to send the money, you will get the rate you locked-in regardless of the current rate.

Whether you are buying a resale or new build/off-plan property, a forward contract can help you avoid losing a massive amount of money. It also makes budgeting much easier because you know exactly how much you will need.

Resale Property – When buying a resale property, typically, you’ll pay a deposit and the balance at a point in the future while your lawyer does all the checks on the property. Sometimes, the balance payment can be many months after the initial deposit payment. You can lock-in a favourable exchange rate for the balance payment while arranging the deposit payment, giving you peace of mind.

New-Build/Off-Plan Property – Similarly, when your property is not yet built, and you have to make multiple payments at various points during the build, you can lock-in the exchange rate for the entire project. You simply make payments as required through the build at the favourable exchange rate.

Surprisingly, many still fail to prepare. When the payments are due, they go to their high-street bank and take the ‘spot rate’, the exchange rate on the day. The difference between a locked-in favourable rate can run into the tens of thousands.

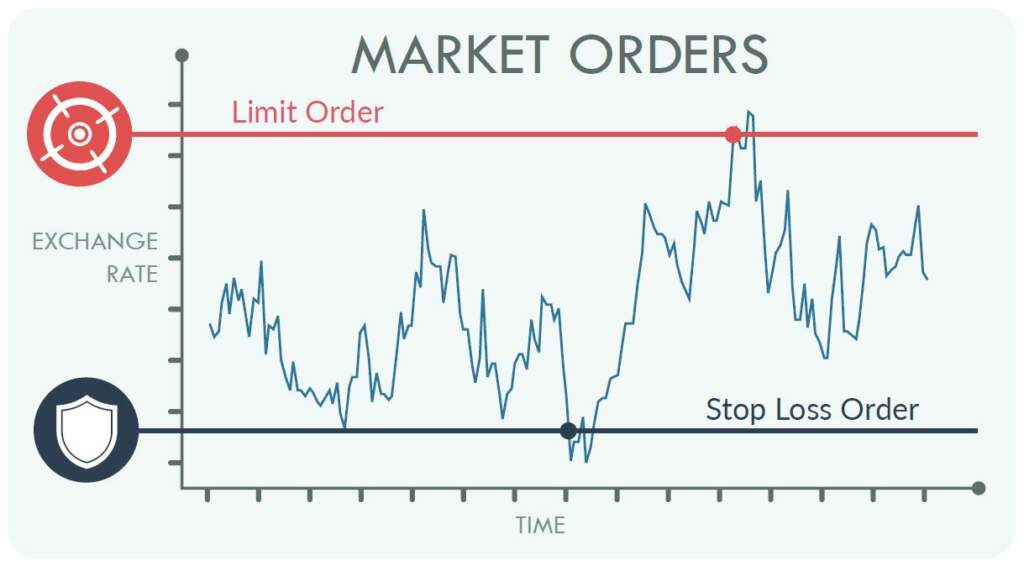

When you need to make a payment soon but have some flexibility on the timing, you might want to consider Limit and Stop-Loss Orders. Your exchange rate is automatically secured if the market hits your target rate. Similarly, a Stop-Loss Order triggers to prevent you from losing any more money. The two can be combined to hold out for a target rate while protecting against a turn in the market. Since it is automatic, you don’t have to spend time watching the markets.

Hopefully, this has shown you how straightforward it is to avoid losing thousands on your overseas property purchase. Currency markets will continue to be volatile. These tools and the help of a currency specialist will ensure your finances are under control. Giving you a potentially larger budget and peace of mind when buying your overseas property.

Get a free currency quote from Hawk FX – International Money Transfer Experts.